How does the customer experience affect delivery routes? What are the low-hanging fruits of making deliveries and where can companies differentiate? George Shchegolev, co-founder and VP of operations at Route4Me, answers these questions and more as he shares what happens behind the scenes to make fast deliveries possible.

Delivery Route Planning: A Hotbed for Innovation

Show Me That You Know Me

It’s no secret that consumers want and expect personalized experiences from brands. In an increasingly data- and technology-driven marketplace, companies can’t simply predict the needs and preferences of their customers; they need to go a step further and anticipate them. Brands that take the time to learn why their customers buy goods and services—not merely what they buy—will fare the best amid evolving customer journeys, experts say. But while many are embracing personalization, its nuances and potential pitfalls are causing some to miss the mark.

“Personalization is part of the experience; it actually is survival now,” says Jeriad Zoghby, global personalization lead at Accenture Interactive. “If you can’t personalize your experience, you risk becoming a commodity.” Brands need to truly differentiate themselves if they want to stand out, or they could be left behind.

“We had an evolution happen where we moved from customization to personalization through segmentation, [but] this new era of personalization now is all about individualization,” says Brendan Wichter, vice president and principal analyst for digital business strategy at Forrester. “What kind of relevant, real-time, value-added experiences can you provide me on my path to purchase?”

It’s no longer enough to segment customers, he says, using an example of a clothing retailer. A brand may notice a male shopper may like to buy sweaters, for instance, but needs to delve deeper to cull and react to his habits: If he tends to shop on weekends, the brand should send him communications on Fridays; the brand should notice whether he tends to buy multiple sweaters at once or prefers to buy entire outfits at a time.

“It’s about what makes us, us,” Wichter says. Personalization has been around for decades, mainly in the form of product recommendations, but “today it’s about content, it’s about cadence, it’s about customer engagement,” he says. “Everything can be personalized, even features and functionality, whether [customers] see it or not.”

Customers want to control their journey

Most consumers (91 percent) are more likely to shop with brands that recognize them, remember them, and provide relevant offers and recommendations, according to the 2018 Personalization Pulse Check, a global Accenture study. And 83 percent may share their data if it’ll give them a more personalized experience. “Instead of businesses defining their journeys, consumers want brands to design experiences that help them create their own,” according to the Accenture report. But some brands are falling short. The study found 48 percent of consumers have left a brand’s website, opting to buy on another site or in store because the site was poorly curated.

“This statistic has increased in every region surveyed, indicating that digital experiences are trending in the wrong direction,” the report reads. “Consumers are leaving brand websites and making purchases elsewhere at a higher rate than a year ago because expectations are growing faster than the experiences are evolving.”

Brands that do personalization successfully understand what drives consumers to act, Zoghby says. “It’s almost, at the end of the day, a better form of listening,” he says. “Companies are starting to finally figure this out. It seems like a small step, but it’s really not done [in many cases]. Most companies know what you do; they don’t know why you do it.” There’s a shift underway in which brands need to move beyond prediction into anticipation, he adds, and savvy brands are letting customers be in control of the journey.

A big piece of that puzzle, Wichter says, is data analysis.“To have a personalization strategy, you need to have a data strategy,” he says. “Organizations that don’t recognize that aren’t able to do great personalization.” Netflix is a brand that excels in this, says Robb Hecht, adjunct professor of marketing at Baruch College in New York City, part of the City University of New York system.

“Every move Netflix makes is driven by vast amounts of data and, in a way, your ‘watchlist’ is as much customized by the company as it is by the user,” says Hecht, who teaches outcomes-focused marketing. “The service, which runs hundreds of A/B tests per year, knows when you press play or hit pause, when you stop watching a title partway through, when you click that little ‘+’ button to add something. It harvests information from over 275 million member profiles, then feeds the data into its personalization endeavors. This is why no user is ever shown the exact same combination rows on the Netflix ‘start’ page.”

A two-way conversation with brands

Another key is creating opportunities for dialogue with consumers, Wichter says, noting beauty retailer Sephora does this well. Sephora shoppers can use in-store beauty stations to say what they like and don’t like, use an app to virtually try on products and give feedback, and visit the company’s website to discuss what products interest them—all meaningful opportunities for dialogue and data collection, he says.

“This is not that hard,” he says. “The technology can be expensive, but this is not emerging technology—it’s out there.”

Zoghby foresees brands re-focusing on expertise. Whereas in the past shoppers used to find experts in brick-and-mortar stores, brands today can offer the same type of concierge service, he says—but digitally.

“The trend is moving from recommendations to advice, because recommendations aren’t advice,” he says. Amazon, he adds, is one company already doing this with its fashion service that allows consumers to get wardrobe advice from the comfort of their homes. Recommendations are merely the results of curating, he says, whereas advice is “thinking to ask you questions you wouldn’t ask yourself. Expertise can be a brand differentiator.”

Personalization is in the eye of the beholder

As some have learned the hard way, personalization isn’t always easy. As Wichter puts it: “It’s only personalization when you get it right.” Making it more challenging, he adds, “Personalization is determined by the receiver. That’s a big eye-opener for companies today.”

Some brands mistakenly expect their efforts to immediately result in sales, he says. “Don’t focus on personalization for conversions; don’t worry about that. You’re trying to create loyalty. In this day and age, loyalty means something. If you can create loyalty, you’re a differentiated brand.”Another common misstep is underappreciating the value of testing, Zoghby says. Successful companies “test like crazy,” he says, and they test everything: from data use and cost effectiveness to placement and font sizes.

“Testing creates the orchestration of the experience, and that’s why testing should never be pushed to the back; it should always be in the forefront,” Zoghby says. “Most companies don’t have the talent [in house] yet to do this. A lot of them struggle because they don’t have those skill sets internally.”

Brands also need to be mindful of how much to push the boundaries, Hecht warns.

“Over-personalization can be a pitfall,” he says. Customers want brands to know and remember them, but “consumers also don’t want to be too overtly re-targeted, feel like they are being stalked, or feel like they are receiving offers that tap into too-sensitive information.”

It can be a fine line, and well-intentioned attempts to offer customized experiences could veer from personal to “creepy.” Most of the consumers (73 percent) in the Accenture study said a business has never communicated with them online in a way that felt too invasive—but it does happen. Of the 27 percent of consumers who said they have had a brand experience that was too personal, 64 percent said it was because the brand had information about the consumer that the consumer didn’t share knowingly or directly—for example, a brand made a recommendation based on a purchase a consumer made with another business.

When asked what they consider to be the “creepiest engagement tactics,” 41 percent of consumers said getting a text from a brand or retailer when walking by a store; 40 percent said receiving a mobile notification after walking by a store, and 35 percent cited ads on social sites for items browsed on a brand website.

“Too often in personalization, we don’t translate [the strategy] back to the real world,” says Zoghby. Some things that seem good on paper are too much when actually put into use. There are some generational differences among consumers in what’s creepy and what’s not, he adds. Younger consumers are less likely to feel targeted personalization efforts cross the line than their older counterparts. But over time, older consumers have been willing to adapt to changing trends, even if not as quickly as millennials, Zoghby says.

Stay human

Generally, most people are happy to share data if they feel a brand will use it to create a better experience for them, he says. “There’s nothing more frustrating than having to remind a brand who you are, why you’re calling, and what you want.”

Adds Wichter, “We like to feel like someone understands us. You feel known and understood. You can’t discount the value of human emotions. We love to feel understood; don’t discount that as a brand.” It can be easy for brands to get immersed in the data and lose sight of the bigger picture, but they must keep in mind who they ultimately aim to serve, says Hecht.

“As brands increasingly transition from products to services, and rebuild customer relations over time, it will be tempting to over-personalize,” he says. “But remember, you have to work with the customer, read the customer. Real humans are at the center of the digital experience—not the marketing technology and databases.”

Make Every Voice Heard With Speech Analytics

There’s an old saying that says sometimes you have to look back to move forward. In the contact center space, interaction analytics, also known as speech analytics, provide organizations with 20/20 vision on their customer interactions and a path for action to enhance them. As contact centers become increasingly digital and add new voice-based channels, more organizations are looking to speech analytics for insights.

But as speech analytics adoption continues to grow, organizations may rush to implement the technology while overlooking key benefits. It’s important that leaders understand where speech analytics can best be utilized to understand associate and customer conversations at different moments of the journey.

Based on my experience and TTEC’s growing capabilities around this technology, here are four key areas where speech analytics can help an organization foster growth, enhance the customer’s journey, and train associates faster and more effectively.

1. Enhanced training

Speech analytics is a fantastic method for discovering information that can be leveraged to train associates productively. Speech analytics identifies not only the keywords, phrases, and emerging topics that are driving successful engagements, but also the cadence in which they should be said or written during the engagement.

Deep diving into past dialogue can help identify what top-performing associates do when interacting with customers and provide insights for other associates, as well as improve the actions of bottom performers. But the main goal isn’t about singling out those who are struggling. Rather, speech analytics can be used to identify coaching opportunities to develop employee skill sets.

How to get it done: Word cloud coaching creates a word cloud of an associate’s language capturing the flow of their conversations. It utilizes replies and reactions in an associate’s dialogue to create coachable insights. Leaders can use word clouds to show associates which aspects of their daily activities need improvement and then guide them on how an ideal conversation should flow. Illustrating a conversation provides a tangible and interactive learning opportunity, as opposed to simply listening to prior calls. As a result, we’ve seen an increase in moving from nesting to full productivity by about 20 percent. In addition, associate attrition was reduced; associates know what is expected of them, and they have a path to achieve their goals.

2. Personalized customer support

If contact centers are to adapt to changing customer expectations, the customer journey must be understood and enhanced. Our experience has shown that there isn’t just one clear path to solving a problem. Every customer enters into the engagement with a unique set of thoughts and expectations. Mapping the customer journey and aligning engagement strategies to meet individual paths drive desired results. Speech analytics provide insight to ensure the right strategies are leveraged through metrics and performance for groups and sometimes to the individual level.

How to get it done: Identify insights into points of the customer journey and develop processes and tactics to deliver the right message to the right person at the right time. Additionally, identify call drivers to enable customer self-service, improve associate training, and enhance call routing.

3. Deeper voice of the customer insights

Speech analytics can be invaluable in uncovering the voice of the customer. Customer sentiment, thoughts about your company and your competitors, emerging topics of relevance and importance, and insights into what your customers care about the most can all be found through interaction or speech analytics.

How to get it done: Share insights from the voice of the customer in the contact center throughout your organization, driving product enhancements, market share gains, increased customer lifetime value, and higher customer satisfaction scores.

4. Enhanced quality assurance and compliance

Quality assurance has traditionally focused on a sample set of calls that are listened to, measured on a scorecard of simple metrics, and applied in coaching that changes results in small steps. But in this environment, a quality assurance team can only listen to so many calls, and their feedback from random calls will not paint an honest picture of what is going on with the majority of associates.

Using speech analytics, you can now “listen” to all interactions, calls, chats, SMS texts, and gain insights into what is really working. Speech analytics can align your quality assurance teams to talking points that impact outcomes and drive the achievement of goals. Furthermore, the added rigor and insights into compliance achievement mitigate the risk a non-compliant interaction can have on a customer relationship.

How to get it done: A more comprehensive approach to quality assurance across the entire engagement cycle provides insights at every point of the interaction between the customer and associate. The findings can help understand the bigger picture of their relationship and a better grasp of the different points of engagement between them.

Unlock your full analytics potential

The true value in interaction and speech analytics comes from applying the processes, uncovering the data, and developing the insights within an operational program that delivers results and feeds the business intelligence machine.

These insights impact many operational areas through business intelligence, particularly in training and curriculum development, coaching, performance, and management. Holistic views and correlation analysis allow us to take seemingly disparate data variables and see the story of cause-and-effect unfold.

For example, a correlation of top reps with more negative sentiment calls and long average handle time (AHT) are analyzed against revenue results. The outcomes tell us that traditional metrics take on a new meaning and value when going outside of traditional scores to discover more pain points. New issues are identified and fixed, resulting in longer associate engagement and higher revenue.

Actions, insights, results

In a contact center, thousands of voices speak at once, but so few are heard. As the renowned author Stephen Covey once said, “Most people do not listen with the intent to understand; they listen with the intent to reply.” It is time to listen to what our associates and customers have to say using interaction and speech analytics, then apply them to help each interaction grow and mature.

Tell a Story With IoT

IoT (Internet of Things) devices, products that are connected to multiple channels (think Google Home or any smart home device), are redefining how consumers interact with technology, just look at the UK baby whose first word was Alexa. The recent Connected Future Summit gathered experts and pioneers in this field to contemplate a world that is becoming more connected.

Where is IoT now?

The appeal of IoT devices is how it can streamline many simple tasks, like turning off the lights or playing the news, into only a few devices. Rachel Schwartz, head of business strategy at Bose, cited the sense of control, communication, and access of information as huge incentives for users to jump on board. And consumer adoption is growing—1 in 4 homes have smart speakers to compared to almost none five years ago. But they are not without their own problems.

When pondering the state of IoT, Greg Kahn, president and CEO of Internet of Things Consortium, didn’t wear rose colored glasses. Throwing out a baseball analogy, he said, “We are at the top of the second inning.” IoT still has a long way to go.

“IoT is growing more slowly than it was predicted in 2015,” echoed Bretty May, COO and GM of McKinsey & Co. He cited an executive survey that found 90 percent of respondents are actively participating in IoT initiatives, but only a third have deployed past the pilot phase.

Many of the speakers said that users are facing a huge educational gap on how to use their devices apart from the original intent of purpose (i.e. using your Alexa as a speaker or ordering products). This is coupled with a sense of mistrust of how these devices may use data or invade user privacy. Recent research from the Internet Society revealed that 75 percent of people are concerned about the way IoT devices will use their data without their permission. Meanwhile, 63 percent find data collection creepy.

It is time to be more human

The consensus amongst some of the top companies at the conference, ranging from Google to Bose, was that organizations need to create more experiential moments with their products for consumers. Essentially, give customers (and clearly explain) the opportunities to experience firsthand how these connected devices can improve their lives.

David Wertheimer, former president of digital products at Fox, stated, “we are doing a great job of moving the product,” but customers need to understand the value proposition to engage with them more. “Many industries have this issue of trying to broadcast messages to people and not treat them as individuals [with] their particular needs and issues.”

Companies need to listen and speak to their customers on a more authentic level. Mark Spates, product lead for smart speakers at Google, said brands need to do a better job of explaining the value proposition of smart devices to users and tell stories on how they can impact their lives, like how smart devices are a great approach to monitoring your baby or your child’s internet usage.

The many voices of IoT

Ultimately, it’s the consumer in the end that decides the IoT winners, added Derrick Dicoi, vice president of strategy and product management at Xfinity Home for Comcast. Product sales, customer adoption and long-term retention will be the best metrics of success.

Kathryn Harrison, founder of DeepTrust Alliance, wanted everyone in attendance to consider how IoT technology will affect everyday life. “Look at things not just as the tech but the portfolio of experiences we need in order to consume them,” she says.

Every year will feature a slicker and more promising IoT device. But if organizations do not get the experience right, users will continue to use these devices in a limited, less trusting way.

Capture the Moment: A Data-Driven Strategy

As consumers, we live in a golden age. It has never been easier to find, purchase, watch, or listen to what we want, when we want it. These are the “I want [fill in the blank] moments” where consumers are looking for information, entertainment, assistance, or something else. These moments matter to brands because this is when decisions are being made and preferences are being set—moments when brands need to deliver the right experience at the right time.

But which moments are the most impactful and how can brands identify and capitalize on those instances? With so many touchpoints in the customer lifecycle, it’s difficult to know what to focus on. This is why a data insights strategy is vital to measuring, understanding, and ultimately winning the moments that matter.

Win the Moments that Matter

Consider these two examples: Years ago a colleague of mine purchased a new sofa. Several months later, the store called her to ask if she was pleased with it. She was surprised and delighted with the follow up and told many friends about the experience, even though the purchase happened some time ago. She appreciated that the store still cared about her months after making the sale.

Meanwhile, another friend told me about the difficulty she had returning a product. She had a bad customer experience, one where her expectations were not met, and that experience colored her beliefs about the product and the brand that made it. She thought it should be easy to return the product but it wasn’t.

For brands to win moments that matter, they must make them personally relevant and exceed expectations. I once worked at a company where employees could praise their colleagues by filling out recognition cards with the person’s name and the reason that they deserved recognition. This is a common practice, but what was uncommon is that the head of the company would personally deliver the recognition cards and thank employees for their hard work. To this day, I recall the thrill of watching the CEO walk around the floor and stop at people’s desks. This act of thanks engendered a lot of employee goodwill and staff retention.

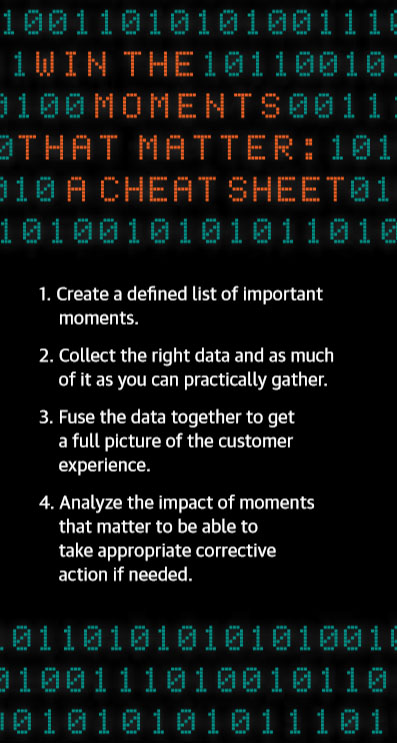

So how do businesses measure how much benefit is gained from having the CEO personally thank employees, or from other moments that matter? It is a four-step process, and much of it centers around data. First, focus on a defined list of moments that matter. Second, collect the right data and as much of it as you can practically gather. Third, fuse the data together to get a full picture of the customer experience. Finally, analyze the impact of moments that matter to take appropriate corrective action if needed.

Define the Moments to Measure

There are many potential moments that matter across the customer lifecycle, and it is easy to become overwhelmed. For companies with a customer journey map, this is the ideal place to start. Select moments to measure based on their importance and your ability to capture data around them.

If you do not have a customer journey map, consider grouping your customers into these six stages, described by KPMG Nunwood, and determine which are the most important to measure first:

- Wooing: This early stage is when the foundation of a relationship is laid.

- Purchase: A key moment that matters, this is when promises are made and expectations are set.

- Honeymoon: At this point, right after the purchase, the customer and business alike are looking to reinforce the decisions they made to be in this relationship.

- Forming: This is when the customer and company are figuring out the best way to work together.

- Storming: Once the honeymoon ends, reality takes hold. Problems can arise and need to be resolved quickly to maintain the relationship.

- Norming: In this stage, standards are set and agreements are made outlining how the relationship between brand and consumer will work.

Collect and Fuse the Right Data

To accurately measure moments that matter, companies need a range of data about their customers to develop a comprehensive understanding of who they are, what they have purchased, how they interact and engage with the company, and their attitudes toward the brand. Data should be as diverse as possible—but be wary that large gaps in data will provide, at best, an incomplete picture and, at worst, a misleading one.

When researching and evaluating data to include, consider:

- Demographics (or firmographic data for B2B companies).

- Purchase history (both online and in-store).

- Loyalty program data.

- Omnichannel engagement, such as app usage, browsing behavior, email engagement, and social interactions.

- Customer feedback, including structured feedback like surveys, as well as unstructured feedback like calls to the contact center or social media posts.

- Customers’ emotions and attitudes about the brand.

To get value from this data, companies need to fuse the various data sources. It is particularly important to integrate customers’ online and offline activity. Much of consumers’ product research and shopping happens online.In addition, they engage with a brand and provide valuable feedback digitally. Remember, people are omnichannel, so data needs to be omnichannel too. Some online data may be difficult to integrate, but identity matching can help link some online and offline behaviors.

Analyze the Impact

Next, brands need to identify the outcome metric or success metric they want to measure, such as revenue or additional products purchased. But for some industries, it could be unlikely that a customer will make another purchase if the customer is early in the lifecycle. In that case, keeping the customer engaged until they are ready to buy again can be an outcome measure.

Once an outcome metric is established, measure how interactions impact the desired behavior. For example, measure the additional revenue or return visits generated with a positive experience versus a negative one during a moment that matters. The difference is the impact of a positive experience over a negative one. It may be that a single, poor experience causes some consumers to switch to a competitor, but it is not necessarily so. There are other mitigating factors such as convenience, habit, or loyalty that will keep customers returning despite a bad experience.

For example, we have found that loyal customers are likely to return to a brand, despite having a bad experience. Unlike new customers, they view a bad experience within the context of all the other experiences they have had with a brand and recognize that bad experience as an aberration rather than the norm. New customers don’t have that history to draw upon. Regardless, it is important to resolve a bad customer experience quickly, as customers will be more willing to come back if their problem was resolved satisfactorily.

Knowing the impact of a good experience over bad, brands can wisely allocate dollars and work on resolving poor experiences during the moments that matter. Plus, armed with detailed data about both the consumer and their experience, companies can provide a remedy that is tailored to the situation and the individual. In some cases, a heartfelt sorry is enough and in others, goodwill in the form of a coupon or discount is required.

One caveat: Those remedies need to be personally relevant but not creepy. Consumers provide data with the expectation that it will be used wisely and not intrusively. Providing a remedy that makes the consumer feel unsettled or uncomfortable defeats the purpose. Companies have to walk a fine line—offering a personalized experience without crossing over to invasiveness. Plus, data might be wrong; a colleague of mine recently checked her profile that a third-party data aggregator had compiled and found some glaring errors. The resolution of a bad experience should leave the consumer feeling satisfied and restore their positive view of the company.

Automation and AI are Making Contact Centers More Human

Contact centers are undergoing a digital transformation that reimagines customer engagement—but don’t count humans out. At ICMI Contact Center Connections, industry experts laid out the many ways that digital technology augments, rather than replaces, human associates. Here are the critical ways that technology can help companies be more human.

An IVR evolution

If one were to believe various publications, voice channels and contact center associates have been eradicated by chatbots. “The Phone Call is Dead,” declared TechCrunch. “Implementing chatbots is all but a must in most industries,” stated VentureBeat. Research firms also support these assertions: By 2020 customers will manage 85 percent of their relationship with an enterprise without interacting with a human, predicts Gartner.

It’s true that customers don’t want to wait several minutes to speak with a human or navigate an outdated interactive voice response system (IVR). Customers want a fast and easy way to solve their problems. But automated solutions provide limited support and customers still prefer human communication for certain interactions, such as tense and emotional issues.

Which is why voice channels aren’t going anywhere, noted Rebecca Roemen, senior consultant of CX strategy and operations at TTEC and an ICMI Movers & Shakers honoree. “Voice is not dying—it’s changing,” she said. Roemen outlined the various technologies and capabilities that are improving voice in the contact center, such as voice biometrics, conversational IVR, natural language processing, and sentiment behavioral analytics. So, instead of trapping customers in a never-ending loop, IVR systems should simply ask, “how can we help you today?” and route customers quickly and accurately.

Voice channels such as IVR are evolving to be more efficient, personalized, and part of the broader customer experience via the Internet of Things, Roemen explained. While even advanced IVR systems aren’t a set-it-and-forget-it solution (they still need regular testing and monitoring), expect leading companies to usher in a more conversational experience.

Live chat: Beware of unforced errors

There are many things to love about supporting customers over live chat. If executed properly, associates can provide support to several customers at nearly the same time on different platforms and devices, and customers receive answers faster than other channels.

However, companies are undermining themselves with poor chat practices, said Leslie O’Flahavan, co-founder and partner at E-Write. “The quality [of live chat] should be better than it is right now, but companies are creating pointless hurdles at the start,” she said.

Those hurdles include being deceptive about wait times, asking customers for a lot of information before initiating a chat, giving overly scripted responses, and failing to train employees on how to interact with customers over chat.

“Chat is like written phone,” O’Flahavan said. As such, there are best practices that associates can borrow from other channels, like voice and email. To help associates deliver quality support over chat, O’Flahavan suggested using both open and closed questions to probe for more information, utilize links and visuals, and match the customer’s level of formality. And most important, “if you can’t staff the channel, take it down.”

As business leaders focus their attention on growth, understanding customers’ needs and expectations, developing strong customer relationships, and driving loyalty are business imperatives. And the companies that deliver smarter customer support in the contact center will have a significant competitive advantage on every front.

Aldo Crowns User-Generated Content King

Ask any millennial what an influencer is and you will hear about vibrant social media stars who flaunt the latest trends in food, fashion, and health. These players have transformed who has a voice across many industries, for better or for worse. And now retailers are testing just how influential they themselves can be.

Organizations have begun to tap into user-generated content (UGC) by sharing media created by people who are wearing or using their products. It’s a growing effort of brands to build the authentic interactions that modern shoppers desire.

But for Aldo Group, a Canadian-based shoe retailer spanning 105 countries, UGC needs to be meaningful, genuine, and impactful on the screen and in the real world. With an Instagram following of over 2 million people—many of whom share snapshots of Aldo products around the globe—Aldo maintains a delicate balancing act of finding the right users with the right values to be their voice. Amanda Amar, Aldo’s senior manager of Global Social Media and Influencer Relations, discussed the value of diving into the UGC environment.

What are the advantages of sharing UGC for retailers?

Amanda Amar: UGC is one of the most authentic and trusted forms of marketing for good reason. Customers more than ever want to be inspired by real people. It’s the same way written reviews are so critical in a purchasing decision today. If you’re going on a vacation you’re going to check all the reviews. In a sense UGC is comparable. It’s your inspirational hyper-visual product review.

That’s why it’s so important that each and every single piece of content or collaboration you publish as a brand is authentic in terms of the ambassadorship, even if it is paid. We really let our Aldo Crew do the talking for us in many instances, and we love getting inspired by how they style our products.

So Aldo Crew is more than just a hashtag?

AA: It’s our community we’ve built up. It’s a funny story, we knew we needed a community hashtag years ago and #AldoCrew originated from our store staff who were organically tagging #AldoCrew in posts at work. We loved that they were our front-line ambassadors, and now #AldoCrew is anybody who is an endorser of the brand and anybody who loves Aldo, from our internal employees, to influencers, to our consumers.

It’s about that sense of community. We are constantly nurturing our community with two-way engagement tactics and seeding strategies, which contributes to us being tagged in over around 33,000 tags on #AldoCrew in the past two years. Our fans love following it and tagging it so they can get a lot of likes and eyeballs [as well]. It’s great for everybody.

How has Aldo’s involvement in social media grown over the years?

AA: We’ve revised our strategies and really amplified our outreach programs, whether it’s through our network of Aldo Crew influencers or getting into the nitty-gritty of consumer and channel insights to really understand what is it that our customers want to see from us, how often do they want to see it, and who do they want to see it on.

What role does UGC play in driving engagement for Aldo?

AA: It’s massive. UGC has become anywhere from 60 to 80 percent of our content mix on social media. It’s really about listening to the voices of our fans and followers. UGC is one of the most trusted forms of marketing today and it’s an organic genuine endorsement. It’s important for us to make sure, especially when you’re working with the top tier influencers, that their endorsement feels genuine and that they’re actual ambassadors of the brand and product.

In all transparency, customers are able see through endorsements that aren’t genuine, whether it’s through the influencer’s channel or if it just doesn’t come across in the right way. So that’s something we have to ensure. We’ve definitely had instances where we’ve tried to work with different talents in the past and maybe they’ve had tremendous channel performance or a really healthy account, but they were not morally up to par, or it felt like a pay-to-play exchange, which is something we do not work further with.

At Aldo our core values are love, respect, and integrity. Those values are very close to our founder’s heart and remain our guiding principles for the 47 years we’ve been in business.

So is there a particular vetting process that you use for the content you share?

AA: Beyond the look and feel, genuine ambassadors are key. We don’t want to work with just anyone unless they genuinely love the product and the brand, even if they’re the hottest influencer in the fashion game at that point in time. It’s integral for our brand fit as well as [the influencer’s] brand that the collaboration be genuine.

We’ve refined our process around vetting influencers as our investments increased. Three years ago it may have been, “They look like the right person, they have a lot of likes, and their feed seems healthy,” but we’ve matured that process. We dig into the values of the talent with as much information that is available.

Besides likes and follows, what metrics do you use to determine if an influencer could be a good fit for your brand?

AA: We’ve discovered it’s so important not to look just at likes, followers, and number of comments on measuring influencers. They’re very broad things and, as we all know, those metrics can often be faked. That’s why it’s important for us to invest in additional tools and services to help us better understand the health of the potential collaborators, as well as having an open and transparent relationship with the influencers we are working with.

Curalate is one of those tools. We’ve seen a lot of benefit from their Influencer suite. It allows us not only to search and discover new talent based on many refinement fields, but then allows us to create “influencer lists” where the tool combines our campaigns and allows us to live view all performance metrics of that specific campaign. If you can imagine, we used to do this manually! I still have PTSD!

Does utilizing UGC give you a pretty good picture of your consumer base?

AA: A standout example for us is when we discover super fans. When I say super fans, I don’t even know if that term can give these people justice because we’ve found them to have over 500 pairs of Aldo shoes in their closet and they’ll send us photos of it and it’s wild. So we try to give these people a lot of extra love; whether it’s creating a custom pair of their favorite silhouette that is monogrammed with their initials or simply ensuring to repost their content and give them a shoutout. We have a social footprint of over 8 million across all our social channels, but we do our very best to engage with each and every one. A like and little comment on the post isn’t enough. These are truly people who love the brand and in no way have been paid, they’re real ambassadors.

Are there other brands that you consider experts in the UGC game?

AA: There’s a ton of companies that are doing a great job. I think especially in the last year, people have really started to figure out and transition into a well-oiled machine. Who stands out to us are [the retailers] ASOS, Revolve, and Nasty Gal. This is because of the propensity and efficiency of their ongoing influencer game, they’re really on top of it and they’re very true to who their brand is. Even if their look and feel might not be ours, you can really feel a point of view. They’re really good in terms of briefing that content and making sure that it’s not just a beautiful piece of content that doesn’t fit with the brand ethos, it’s always authentic.

Any tips for brands who want to engage more with UGC?

AA: The number one thing that people take for granted is that engagement piece with their fans, and not just the influential fans, but the thousands of followers. It’s from the micro-tier to the tippy-top of the pyramid where you’re at celebrity level—make sure that engagement piece is always on.

Another thing that would be incredible, especially for brands who don’t necessarily have the budget for larger endorsements, is gifting programs. That’s making sure that you are getting your product in the hands of the talent that you work with and if they genuinely love the product, more often than not they’ll post about it. So make sure that the un-boxing experience is really true to your brand and they feel your brand DNA, from opening up the package to moments that they are looking at the product and using it.

And it’s that authenticity piece. Don’t sell out just because somebody has 5 million followers on Instagram. If that person is not the right fit or isn’t morally sound, it’s just not worth it.

4 Ways to Define Your 5G Customer Experience (Before a Competitor Does It for You)

The next generation of cellular networks—also known as 5G—is set to greatly enhance the speed, connections, and responsiveness of wireless devices. So, what does that mean for the customer experience? Given that the average U.S. adult spends nearly four hours using a smartphone each day, 5G will have a significant impact on consumer behavior and offer new levels of data-driven engagement.

The deployment of 5G mobile networks is still in its early stages. AT&T, Sprint, T-Mobile, and Verizon have launched 5G networks in various cities and will be expanding those networks through 2020. But to leverage 5G effectively, companies need to begin thinking about the best ways to use it to differentiate their customer experience. Here are four ideas to start with.

1. Make immersive experiences a reality

Augmented reality and virtual reality need a high-bandwidth and low-latency network to deliver optimal experiences. A slight lag could disrupt the experience. The improvements that 5G makes in download speed, latency, and data capacity will enable brands to make cutting-edge experiences more accessible, says Jeff Reed, a professor of electrical and computer engineering at Virginia Tech.

“Imagine you’re a tourist in Washington, D.C. and you pull out your phone to watch a historical event superimposed on the actual site that you’re visiting,” he says. “With 5G, using augmented reality could become common practice.” As 5G matures, brands will have an opportunity to greatly enhance the customer experience by making immersive experiences the norm rather than a novelty.

2. Real-time personalization

Research shows that customers want faster, more personalized interactions with brands, and 5G could enable companies to deliver exactly that. Think of walking down a grocery aisle and pointing your phone at the cereal boxes to highlight the ones that don’t contain wheat or some other ingredient. Or a retailer can make informed decisions to optimize in-store offers based on reports about real-time shopper traffic and demographic information.

Being able to make real-time decisions about consumer behavior thanks to 5G is “going to be a real game changer that will allow marketers to rethink their customer engagement to make it even more personalized,” says with Michele Dupré, group vice president of retail, hospitality/travel at Verizon Enterprise Solutions.

3. An opportunity to get ahead of new behaviors

While Netflix is credited with pioneering binge-watching, streaming high-quality videos wouldn’t have been possible without 4G networks. “We don’t know what the killer apps for 5G will be yet, but just as 4G enabled binge-watching, we can it expect it to affect consumer behavior,” Reed says.

With that in mind, companies should keep an eye on how consumers utilize 5G-powered devices to identify behavior that may complement their products and services. For instance, it’s highly possible that the next ‘killer app’ will include conversational AI and voice search, which will continue to grow as digital assistants and 5G gain wider adoption. At the moment, voice search is only useful for specific requests and narrow purposes, but its effectiveness will expand as the technology advances and more smart devices proliferate.

4. Reimagine the customer journey

As 5G networks grow and accompanying devices gain adoption, companies may need to redraw their customer journey maps to accommodate new mobile experiences. In addition to consumers spending more time on their smartphones, scenarios where devices coordinate with each other may also need to be included. The machine-to-machine (M2M) connections market will be worth $30.74 billion by 2025, according to research firm MarketsandMarkets.

Indeed, creating the right customer experience starts with “identifying your

ideal customers, their habits and their needs, and guiding them through their

buying journey,” Dupré says.

CX Experts Share Tips and Tricks for Getting Messaging Right

The future of customer service rests on an organization’s ability to recognize and meet customers where they are. Incite Group’s 9th Annual Customer Service Summit in Brooklyn focused on a growing and increasingly relevant platform: messaging.

Messaging, text-based conversations on smart devices or platforms like Facebook Messenger, WhatsApp, iMessage, or SMS text messaging, is the go-to tool for customers who live on their phones. But just because customers get messaging, it doesn’t mean businesses do. According to Martech Today, 58 percent of customers are texting businesses that aren’t even set up to respond.

Where are you in messaging?

Rob Lawson, who runs Customer Experience Partnerships at Google, led an interactive roundtable where audience members discussed their challenges with messaging:

- Rethinking the metrics used for messaging compared to traditional channels like voice, partly due to the asynchronous nature of messaging.

- Recognizing the fundamental differences in associate skill sets needed for messaging. An associate with good AHT on voice may not be the same for messaging.

- There is a lack of education around the definition of messaging, with some believing that it’s only an extension of chat.

- Insuring that the influx of platforms—WhatsApp, Messenger, WeChat—are not confusing for the associate.

- Meeting customer expectations for messaging services while complying with different data protection laws and regulations.

But for all the roadblocks, investing in messaging may prove to be an exceptional customer experience tool. Lawson stressed messages’ inclination towards natural conversations, seamless drop-ins and -outs, and its proactiveness, as essential to meeting consumers where they are.

In a market where over a billion people use Facebook Messenger, with billions more on other platforms, the potential outreach is remarkable. According to AdWeek, 68 percent of customers prefer messaging when communicating with a brand.

“The integration of being able to do messaging as your web-based chat is the best of both worlds, it’s asynchronous, [and] it’s private,” Frankie Saucier, head of digital care strategy at Home Depot, says. “It’s as if social and chat had a baby.” Home Depot itself has been deploying Apple Business Chat to meet customers on iMessage.

But having a child takes work.

Concerns about messaging were echoed by Sara McCandless, VP of customer engagement & brand advocacy at Clearlink, who had just led a discussion on issues around live chat.

“Some of the pain points in web-based chat lend themselves to why we are having these messaging conversations,” she said. “…don’t assume that just because you have an agent in one digital channel like email that it will automatically convert into somebody who can speak in chat.”

As attendees questioned web-chat’s evolution into messaging, they stressed that the transition process should be thought out. This tied back to McCandless’s concern over rotating associates from different channels who may lack the right training required for messaging. For example, associates who are not used to the rapid-fire response time of chat or its informal tone. The more conversational messaging interactions from messaging will rewrite the rulebook on AHT.

The transition of technologies (i.e. rotating from web to messaging) will also be very difficult. For this process, McCandless suggested redesigning CRMs to handle spikes in volume and various messaging platforms.

Putting messaging into action

Citibank put messaging best practices to the test when it recognized that customers are increasingly banking on their phones. Citi’s mobile-first community, those who only interact with the brand via their device, had grown from 8 percent in 2016 to 30 percent in 2019. According to Rianna Schano, senior vice president of digital product-messaging & support at Citibank, they needed to adapt to a digital support strategy that fit this growing demographic. Enter messaging.

The secret is taking your time and prioritizing completeness. Before making a full launch, the bank spent half a year experimenting and figuring out their audience before releasing messaging. Here are their top lessons:

- Be careful of the placement. Citibank toyed with placing the messaging button in several locations before selecting the best spot. Moving the messaging button 3 clicks from the loading screen to the header of the app helped double the number of customer-initiated conversations.

- Names matter. If you call it chat, customers expect immediate responses, if it’s called messaging, customers will be more patient with response times (like a real conversation).

- More education is needed. Citibank needed to educate customers on expected response times and train associates to adopt a more informal lingo compared to other channels.

In the past 3 years, Citibank’s messaging operations has grown to 500,000 conversations every month with a 40 percent growth in digital support interactions. This journey continues as platforms like Apple Business Chat and Google My Business become more prevalent.

The need for evolution

Messaging isn’t a new concept, but many businesses are slow to grasp the potential of a simple human conversation on the go. While the development of chatbots and automation will still be crucial for smart customer service, the Customer Service Summit highlighted the need to reinvent how we talk to our customers. Even if it means sending a few more emojis over text.