Customer experience leaders look for employees with emotional intelligence and empathy, traits that work great for helping customers and resolving issues. And in today’s AI-obsessed environment, empathetic human connection is a welcome differentiator for many people who don’t want to navigate an IVR or converse with a chatbot.

But be warned — the more that AI and automation is used within the customer experience, the more likely your human customer-facing employees will feel stressed and experience burnout and compassion fatigue.

With simpler interactions defaulting to automation, human employees will handle mostly escalations or issues that are too complex for automation. They will be the first ones frustrated customers talk to when they can’t resolve their issue or don’t know how to navigate an automated system. Associates who work industries like healthcare, financial services, or insurance are even more vulnerable because the topics they deal with are emotionally charged, such as declining a medical procedure or missed credit card payments.

It’s bound to take a toll on associates, especially those with high levels of compassion and empathy. The traits that make a great customer experience employee – compassion, empathy, problem solving skills – will kick into overdrive with more complex calls.

Stamp out burnout

People are not robots. They have feelings—and can sometimes get overwhelmed by them. And right now, 59% of customer service reps are at risk of burnout, including 28% who are at risk of severe burnout, according to Jeff Toister, author of the Service Culture Handbook. Expect that number to grow in tandem with more automation and AI.

Support your employees by making mental health tools available as part of your company’s employee experience program. Be mindful about providing employees with wellness resources, activities, and time off. And even AI can be helpful to monitor negative sentiment and trigger breaks and other actions when employees get stressed.

The result is a CX future a little less scary—and full of humanity.

A scary CX trend: Employee compassion fatigue and burnout

Where do humans fit in AI’s long tail?

What do music festivals, real estate developers, and the Caribbean island of Anguilla have in common? They all have been greatly impacted by the explosion of generative AI, with no signs of slowing down.

They are part of the AI long tail, where the technology’s explosive growth reverberates and ripples in unexpected ways. And they are just some examples shared by AI experts and practitioners at the recent GAI World conference in Boston.

“AI helps people expand the practical imagination space,” said Dr. John Sviokla, founder of GAI Insights, which hosted the conference.

AI winners and losers

The biggest AI use cases right now are for customer service and document summaries, UBS Stock Analyst Lloyd Walmsley told the audience. And companies have many different experiments going on showing real promise in several areas, he added. Tech stacks and cloud computing need upgrades. There is new demand for networking across the enterprise to transmit data. Customer data foundations must be in place. And then there are the ripples beyond the IT world.

Which brings us back to Anguilla, a tiny island of only 35 square miles in the Eastern Caribbean with a population of about 15,000. I learned at the event that the island nation owns the country domain “.ai” and is poised to generate more than $35 million in domain name registry revenue in 2023, according to Bloomberg. That’s a 5x boost in revenue since 2021, thanks to so many new AI startups launching this year.

Another unique player in the AI boom is the real estate industry. Nadia Lovell, senior U.S. equity strategist at UBS, said at the event that more than 30% of company earnings calls this year referenced AI. Tech companies led the way, followed surprisingly by real estate firms, she said. As AI needs grow, companies need more data centers and cooling facilities, which requires larger real estate investment.

The butterfly effect on human development

The ripples extend to humans as well. Boston University Associate Professor Gordon Burch explained that Large Language Models will be used in the short term to support information-based tasks like debugging code, researching topics, or explaining how to do something. This removes the need for employees—particularly junior employees—to collaborate with others in their workplace community to gain knowledge and expertise.

“Forming employee connections is important, especially for younger employees,” he said. “When using AI, be careful to manufacture opportunities for peers to engage and interact.” It will be up to companies to intentionally foster employee engagement and community that will otherwise disappear because of AI.

On the flip side, the breadth of digitization has pushed people to seek out more human experiences. Sviokla pointed to the growth in music festival attendance as a good example. “There’s a natural tension between the digital and human worlds,” he said. It’s important to strike a balance with human-centered experiences, supported by digital tools, to give people an analog outlet to counteract expanding virtual experiences.

And with the rise of AI, it’s essential to bring current employees along with the right tools and reskilling, said Joe Atkinson, vice chair, U.S. chief products and technology officer at PwC. Atkinson helps lead PwC’s $1 billion investment in GenAI and digital transformation, with a large portion allocated to developing the “next generation of workers.”

“We need to prepare our people to use GenAI or else we are leaving them in harm’s way,” he said.

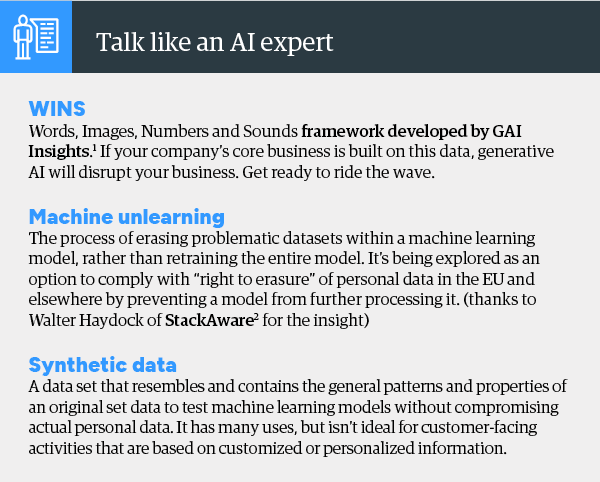

Sources: GAI Insights, StackAware

Will generative AI solve the CX industry’s omnichannel problem?

For decades, contact center and CX organizations have strived to become “omnichannel.” Rather than force customers into interactions dictated by the company, an omnichannel system enables customers to engage with a brand on their channel of choice when, where, and how they prefer.

It’s a great idea, but implementation has proven very difficult, especially for large enterprise organizations working with legacy data and siloed systems. True omnichannel implementation requires integrated contact center software, skilled associates, and customer analytics to connect and orchestrate the customer journey. And that’s much easier said than done.

Separate buzzwords from reality

One obstacle to achieving omnichannel experiences involves how the term, “omnichannel,” is defined. Companies often mistake it for multichannel operations, where customer interactions occur on multiple channels – voice, SMS, chat, social media, etc.

A company is not “omnichannel” just because it is capable of interacting with customers across all channels. If “omnichannel” is to mean anything at all, it must facilitate a customer experience that is seamlessly integrated across all the different channels any particular customer chooses.

A company can only be considered to have “omnichannel” capabilities if the history and context of each customer’s interactions in one channel are flawlessly carried over into the next channel, and the next, and the next.

Though the concept has been discussed for over a decade, more than half of companies still struggle to meet this omnichannel imperative. According to 2023 Omdia research:

- 62% of companies can’t engage across channels in a personalized way

- 55% can’t predict customer needs

- 42% are challenged with using data to obtain customer insights

Gen AI to the rescue?

Generative AI is changing this landscape, said Omdia Principal Analyst Mila D’Antonio at a recent conference. Generative AI bypasses the rules-based functions that hindered previous omnichannel efforts to get closer to an omnichannel reality with personalized responses, content, and product decisions. If the underlying Large Language Model (LLM) contains comprehensive data and integration from multiple sources, you can apply AI across channels to give information context and customers more control in whatever channel they use.

It could be a key to unlocking the promise of omnichannel in the CX world.

Customer experience is more than meets the AI

AI is having a moment.

The technology’s move out of the IT lab to the devices of non-techies has opened up a world of promise and possibility. It has the potential to be the dominant technology for the next decade or longer across industries.

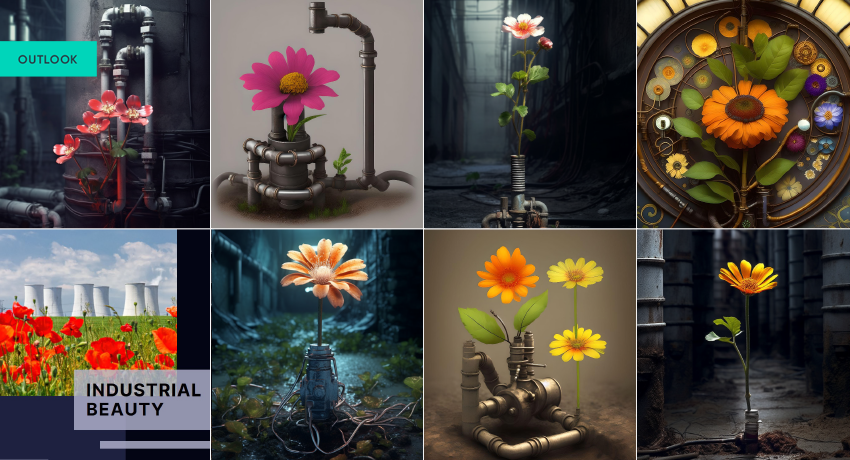

The newest issue of the Customer Strategist Journal explores what the rise of the machines means in the customer experience context. The cover image, “CX blossoms in the age of AI,” was generated by AI tool Midjourney, prompted by our talented designer Joey Haas. She replaced the typical robotic AI imagery with a more abstract and hauntingly beautiful concept, which we hope illustrates to our readers the promise and possibilities that grow from what could be a scary and uncertain technology.

We noticed something interesting in the exercise — a single text prompt generated multiple variations of an image, even when using the same AI image generator. When we tried it with different AI generators, we got a wider variety of visual alternatives.

Below are some of the results returned by the text prompt, “small bright flower with industrial pipes and wires underground instead of roots, hyper-realistic, moody, high resolution.” We used three AI generators: Midjourney, Microsoft Designer, and Fotor. It’s very interesting to see the different directions each tool took, and how different the resulting images are.

It shows that with generative AI, the “truth” is always evolving. The right prompts, context, data input, and human involvement are all needed to work holistically to turn something mediocre into art that evokes emotion. And the technology learns more as it goes, working toward a more perfect outcome. It’s never finished. Kind of like customer experience strategy.

The articles in this issue of the Customer Strategist delve into some of what is needed to make AI work in a customer experience context – from preventing data poisoning to setting a strong CX foundation. Business leaders share their thoughts and actions around AI, and we look at how industries like healthcare are using it to enable welcoming and inclusive spaces.

AI is a technology that is constantly changing and giving users different perspectives from which to build great experiences.

We invite you try to create your own image using the prompt above and share it on our social media page. I’m really curious to see how the concept—AI’s use in CX—evolves.

Show report: A NICE take on AI

With thick wildfire-smoke clouds obscuring the New York skyline outside, NICE CEO Barak Eilam shared some cloud wisdom of his own at the recent NICE Interactions conference.

“Migration to the cloud is an imperative if you want to leverage AI in your contact center,” he told the crowd of nearly 2,000 CX leaders at the Jacob Javits Center. AI was the hot topic, with sessions and panelists about where to start and what building blocks need to be in place to create a successful AI initiative.

“AI is the long-awaited CX alchemist, conjuring up completely new ways that customer service and technology can be welded together,” Eilam told the conference audience.

He shared three steps to “surf the AI super wave” in the realm of customer experience:

1. Complete the move to the cloud, but do it right

The reason for a cloud migration is to create more nimble, agile, integrated contact center systems for customer and associate augmentation. Those attributes are more critical than ever, since customer interactions have increased by 100x and have become more complex in the last decade, Eilam stated. Meanwhile, he said, only 20% of CX organizations are on cloud native platforms.

2. Start over your digital transformation

This might be hard for CX leaders to hear, but Eilam made a compelling case about AI being an integral part of any digital transformation. Adding AI as a stand-alone component bolted on to any current transformations won’t have the same results as including AI as part of the entire transformation. “It’s hard to restart, but AI will turbocharge” any efforts to become more digitally driven, he said.

3. Think big and avoid separate point solutions

Learn from past mistakes and avoid an AI “Frankenstack,” Eilam said. Omnichannel efforts never met their full potential because point solutions were never fully integrated. Take these lessons to heart when incorporating AI solutions into your business for customers and employees.

AI accelerates personalization and generates better experiences

The conference featured sessions and discussions around incorporating AI-enabled tools to improve both the customer and employee experience. Omdia Principal Analyst Mila D’Antonio framed much of the AI discussions as a way to get to more personalized interactions, something that has been only aspirational for most companies. According to 2023 Omdia research:

- 62% of companies can’t engage across channels in a personalized way

- 55% can’t predict customer needs

- 42% are challenged with using data to obtain customer insights

Generative AI is changing this landscape, D’Antonio said, by enabling personalized responses, content, and product decisions. Companies are deploying AI in its first act for agent assist, conversational AI, and dynamic knowledgebases to support associates as they help customers.

According to Omdia, positive outcomes of AI-powered technology include:

- 59% of companies can better understand customer needs

- 57% see increased CSAT

- 57% see higher revenue

- 50% increase their operational efficiency

AI won’t succeed without human employees

Throughout the conference, speakers emphasized the importance of humans in the AI ecosystem. Barry Cooper, president of NICE CX Division, outlined three associate augmentation AI strategies: behavioral guidance to encourage efficiency and the best interactions based on data; giving them context about specific knowledge to create a more holistic interaction; and automation that acts on an associate’s behalf.

“More complex interactions are being done virtually,” he said. “Without AI and automation, companies would need 3x the agents to manage it.” The software is doing things that humans used to do, so humans can do more complex work.

“Don’t displace agents, they will have more meaningful work to do,” D’Antonio said. They may be nervous about what the AI future brings, so talk to them about how you intend to use it, and how it will help them work better and with less hassle. Share opportunities for new human roles emerging from AI, including bot tuners and data scientists, she said.

People will have anger and fear about an AI future, added Sinead Aylward, senior director of IT at Johnson Controls. “Find their crying baby,” to help encourage adoption and show how AI will solve the problems that resonate with employees.

Show report: The ABCs of AI in CX

Last week was one of the CX industry’s biggest events — Customer Contact Week. Of course, the hot topic of the show was AI and how it can be used in the contact center and throughout the customer journey.

I spoke with show attendees and exhibitors to get their take on what AI means for CX and the contact center.

- Logitech’s Adriana Vazquez remarked on the benefit of getting so many points of view together at the show to discuss how to move forward with AI.

- Ginger Conlon from Genesys emphasized the importance of making sure AI is done with the customer experience top of mind.

- The scale and speed of AI can be put to work to find insights across millions of unstructured data points, said Fabrice Martin of Qualtrics.

- Level AI’s Ashish Nagar shared three AI improvements contact center leaders are looking for from tech partners.

Hear more from them in their own words in the video below. And learn more about the intersection of AI and CX in the latest issue of the Customer Strategist Journal.

PODCAST: Fight retail fraud with true customer understanding

Retailers and e-commerce brands are struggling to keep up with fraudsters who keep finding innovative ways to commit fraud. It the latest episode of the CX Pod, get tips from Eyal Elazar, head of product marketing at Riskified about how to fight conventional and unconventional fraud to create better customer experiences.

Key takeaways:

- Digital transformation in retail has led to innovations in how to commit fraud

- An identity approach helps fight conventional and unconventional fraud

- Insight and human-led AI helps brands get to the truth in real time

- Look at the customer journey to understand what you can learn and where vulnerabilities exist

Show report: CX and EX inextricably linked, with empathy as the glue

The power of connectivity was on brilliant display this month in Salt Lake City, where approximately 10,000 customer experience professionals gathered to soak up inspiration and new ideas to deploy upon returning home.

Delta Airlines CEO Ed Bastian’s announcement that in-flight wi-fi would be free for loyalty members went over with flying colors, drawing hoots and rousing applause.

YouTuber and former NASA engineer Mark Rober illustrated the power of connectivity with a science demonstration, releasing thousands of balloons at once to earn a spot in the Guinness World Book of Records.

Less flashy but perhaps more thought-provoking were the words from Nobel Peace Prize laureate Malala Yousafzai, who became an activist for girls education after surviving a gunshot wound to the head as a teenager.

These three individuals from very different walks of life represent just a sampling of the roster of prominent speakers taking the stage at the X4 Summit, the experience management conference hosted by Qualtrics earlier this month. The event, held live after a three-year hiatus, is so named because it focuses on the four pillars of experience management: customer, employee, brand, and product experience.

CX and EX, not one or the other

Yousafzai, speaking on International Women’s Day, called upon business leaders to examine the culture they create to ensure technology career opportunities are available to more women from all backgrounds and that resources needed to flourish at work are accessible to everyone.

Improving the employee experience in this way ultimately enhances the customer experience as well. While some organizations favor CX over EX, or vice versa, it’s become clear the two have become inextricably linked.

“We put our people first so we can deliver an amazing experience for our customers,” said Bastian of Delta, named the top U.S. airline in 2022 by the Wall Street Journal, which scores airlines on seven operations and customer metrics. “We define our business as an experience business. Transportation is what we do,” he added. “Who we are is about the experience.”

Five years in the works, free in-flight wi-fi is now available on 80% of Delta’s U.S. fleet and rollout will be complete by year end. International in-flight wi-fi will follow. Despite all the innovative advances in travel, Bastian said in-flight wi-fi has been an abysmal experience for passengers. “We are closer to the darn satellites in the sky than the ground. Why isn’t it faster in the sky, right?

“We have to solve that because people want to be connected. And that’s what we do. We connect people,” he added. Next month, Delta SkyMiles passengers will enjoy another free perk: in-flight access to Paramount+, the premium video streaming service. In two weeks’ time, 2 million people linked their Delta and Paramount accounts, Bastian said.

Another speaker who underscored the intersection of CX and EX was Penny Stoker, talent leader, executive functions, at global consulting firm EY.

Real-time intelligence

“It’s about putting humans at the center. How do we talk to our employees and how do we foster an environment so they can bring their whole selves to work?” Stoker said during a briefing with analysts, media, and investors. “So often, we design something that works for HR or finance or technology and guess what? It doesn’t work for employees.”

“How do we change that so our employees have a consistent journey so they can work with our clients” to deliver an exceptional experience.

That same sentiment —viewing CS and EX in tandem—spills into other business sectors.

“It’s our vision to bring those data together because in healthcare, the stakes are different with healthcare worker burnout,” said Alpa Vyas, chief patient experience officer, Stanford Health Care. “Our ability to keep our workforce, whether physicians or front-line staff, is really important. If that doesn’t happen, that impacts the experience for our patients. These things are all intrinsically linked.”

While Vyas mentioned a bright spot—she called the ability to gather feedback and respond in near real-time, even before a patient leaves a clinic, a “gamechanger”—there’s much room for improvement. “Healthcare has moved from the 19th Century to the 20th Century when it comes to the experience,” Vyas said. “We have a long way to go and lots of learning to do.”

Acting on developing trends as they surface

Michel Feaster, global head of product marketing and chief product officer of research at Qualtrics, said real-time access to developing trends delivered in a dashboard format enables decision-makers to seize opportunities to improve the experience as they surface.

In financial services, for example, real-time data about behavioral trends would reveal to business leaders that high net worth customers are switching banks right now, because they are chasing high interest rates, she said.

For healthcare, Feaster said timely intelligence around frequency of patient visits, communications channels with highest engagement, and other benchmarks can provide cues to guide next moves to enhance the experience.

Qualtrics Chief Medical Officer Adrienne Boissy, a practicing neurologist, jumped in to suggest where improvements can be made in electronic health records (EHR) systems: “How do patients shape the EHR design?” she told Customer Strategist Journal. “Why are physicians in the EHR and not with their families? Why is the physician in the EHR at 10 o’clock at night?”

Numerous X4 Summit presenters underscored the importance of being proactive, to capture, interpret and respond to behavioral signals quickly.

“The days of having to ask customers about their experiences are over,” said Qualtrics CEO Zig Serafin. He said Qualtrics’ Experience iD (XiD) database has captured 11 billion records from customer interactions across numerous channels, showing preferences and what consumers are likely to want next. The intelligence helps companies identify and resolve points of friction while capitalizing on growth opportunities.

Empathy, genuine empathy

All the juicy data in the world only goes so far. Presenters said business needs to bring humanity to the experience and that means acting on data intelligence with empathy.

In the contact center, Qualtrics conducted research on the presence and absence of empathy during customer interactions. “We found that agents demonstrating empathy—and the person feeling that impact—has twice the impact on loyalty than shorter wait times. People would rather wait longer on hold to get an empathetic experience,” said Brad Anderson, president of products and engineering at Qualtrics.

Empathy is equally crucial to the employee experience.

“Empathy is the term of the day,” said Johnny Taylor, CEO of the Society for Human Resource Management (SHRM). “Empathy is the No. 1 thing employees want from us.”

This is a shift from three years ago, with the onset of the pandemic, when employees were looking for sympathy given all the difficulties, disruption, and despair. Now they’re saying: “I don’t want your sympathy. When you talk to me, think about what I am going through.”

Taylor went on to say business needs to be aware employee psyche is a moving target and this matters in a challenging labor market.

“The war for talent is real and it is worsening,” Taylor said. “The No. 1 issue is wage inflation. Your people want more and as we head into an economic slowdown, your customers don’t want to pay more. We’re in for a collision.”

The average 2022 college graduate expects a $104,000 salary in a first job, he said, a figure that’s nearly double the actual salary of $55,000. “They are pissed because they are working for half what they think they should be getting from you.”

There’s good news, Taylor was happy to offer. For all those employees who left their jobs during the pandemic, 80% regret quitting. “Boomerang is real and it’s an opportunity,” he said, and business would be wise to welcome back high-performing employees who left on good terms.

He suggested checking in with newly departed employees after 30 days to ask: Are you happy in your new job? Then, check in after 90 days to ask if the new employer kept their word about job-related promises. Then, after 120 days, check in to ask a former employee: Do you want to come back?

Don’t succumb to the ‘CX sacrifice’

Whether 2023 will usher in a mild recession or just an economic downturn, no one knows. What’s undeniable is whispers from that devil on your shoulder, “What about headcount?” are getting louder by the day.

Workforce reductions are tempting in the face of economic headwinds but technology and customer experience experts urge contact center leaders to take the long view, and resist. Technology investments will be more tempered in 2023 and that calls for more strategic planning, said panelists on the recent ICMI webinar, “Weathering the Storm: Investing for Long-Term Contact Center Success.”

“A lot of brands have a tendency toward what I call the ‘CX sacrifice,’ reducing staff and decreasing your time to serve. This is a mistake,” said panelist Nick Cerise, chief marketing officer at TTEC.

Instead, Cerise and analysts from global research firm Omdia mapped a path to keep the workforce intact, more productive, and better-equipped to deliver an exceptional customer experience.

Tech spending grows, though more slowly

More than half of global enterprises will increase contact center technology investments this year, said David Myron, principal analyst, contact center technologies, Omdia. Citing results from Omdia’s 2023 IT Enterprise Insights survey, Myron said 59% of companies plan strategic or minor cloud technology investments for the contact center in 2023, down from 63% this year.

Myron said other areas where contact centers will increase technology investment in 2023 include self-service automation and conversational AI/chatbots.

Another Omdia panelist, Mila D’Antonio, principal analyst, connected enterprise, said some companies view a potential economic slowdown as an opportunity to strengthen relationships with customers and invest in artificial intelligence (AI) that yields better business insights and automation.

Strategy, digital transformation

“Companies have to be more strategic in their planning and investments,” she said, “and the data is also telling about how vendors must position themselves on price and service going forward.”

While being more strategic about CX means seeking out savings, the panelists wondered how Frontier Airlines’ recent cost-cutting move to eliminate live telephone support will play out. The discount carrier now directs callers to its website, mobile app, social media, WhatsApp and chat.

“It will be interesting to see how this model works for them,” D’Antonio said. “If it does work, we will start to see more digital-only models take hold as more companies seek that holy grail of lowering costs while elevating the customer experience.”

TTEC’s Cerise said companies’ end goal should not be digital-first to the exclusion of all else. “The aspiration should be: Meet the customers where they are and deliver amazing service,” he said. “Optimize the way you are engaging customers but do it at lower total cost of ownership. That should be the aspiration to start with.”

Intelligent call routing, tools and process change

A chief problem contact centers face is that most customer intents are not intelligently routed, Cerise said. Companies can expect 10% to 20% cost savings just by routing customer inquiries to the correct channel, digital worker or live associate with the right skill set to resolve an issue, he said.

D’Antonio agreed managing channels is a challenge. More than half of North American CX professionals are unable to engage across channels in a relevant and personalized way, she said, citing Omdia’s State of Digital CX 2022 findings.

“We see the highest concentration in strategic and minor investments planned around things like intelligent virtual agents, video chat, and augmented reality,” D’Antonio added. “This points to the need for investing in the latest tools that reduce operating expenditures while elevating CX to meet customer expectations.”

Myron shared more 2023 IT Enterprise Insights findings that quantify spending plans in AI-powered solutions such as social listening/ticketing, digital customer contact analytics, and intelligent call routing.

Understand the why—and the what

Call centers need to examine reasons why customers engage in the first place. They also need to be realistic about what they’re asking associates to do.

“Understand your customer and why they are engaging. Then build a roadmap, a rapid roadmap, to try and solve for that,” Cerise said. That may mean routing a voice call to self-service, or keeping it in voice but deflect to messaging. It may mean routing to video so an associate can see what the customer sees to better troubleshoot a problem, such as crossed wires of a malfunctioning smart thermostat.

Examine your process, Cerise continued. For simple query like, “Where is my order?” associates may have to navigate 13 business applications, he said. “It sounds like I am making that up, but that’s an actual use case.” For this client, average handle time (AHT) of nine minutes was slashed to three minutes with robotic desktop automation TTEC deployed.

With streamlined processes and automation, companies can optimize responses and solve issues pre-emptively. All this leads to the ultimate goal, what Cerise calls “proactive CX.” By understanding customer intents, call centers can create incremental revenue with up-sell and cross-sell opportunities.

“Please don’t fall into that CX sacrifice trap,” Cerise advised. “Do not sacrifice your customer experience and make it horrible because you are just cutting heads.”

Attend the ICMI webinar, “Weathering the Storm: Investing for Long-Term Contact Center Success.”

Seen and heard at NRF: Retailers eye opportunities in 2023, even amid uncertainty

It was clear to anyone who walked into the Javits Center in New York City earlier this month for the National Retail Federation (NRF) Big Show: Trade shows are back. With tens of thousands in attendance, people were ready to mingle, talk strategy, showcase their products, and sample the latest cutting-edge technology.

Here are just a few highlights from the four-day event.

Celebrating a visionary

Lowe’s Chairman and CEO Marvin Ellison received the Visionary Award at the NRF Foundation Honors ceremony. The award, presented to an outstanding retail industry leader each year, celebrated Ellison’s stewardship to drive positive change within the industry.

Ellison delivered a keynote speech later in the show, where he spoke about his commitment to making the Lowe’s workforce and leadership team more diverse. A retail brand’s leadership, he said, should reflect its customer base.

“We’re trying to create a company that I wish I could’ve worked for when I was coming up the ranks,” Ellison said.

The brand focuses on what Ellison called “retail fundamentals:”

- Product selection

- Supply chain

- Operational efficiencies

- Engaging the customer

- Flexible e-commerce

Key to that, Ellison said, was connecting the digital and physical stores. “Next-day delivery sounds good until you have a busted pipe.”

New companies share the spotlight

The Consumer Product Showcase and Innovation Lab gave small business the chance to show off their consumer-facing products and new technology for attendees. Most of the companies in the consumer showcase were minority-owned, women-owned, veteran-owned, disability-owned, or LGBTQ-owned, and innovation lab companies represented countries around the world.

The Consumer Product Showcase featured a wide range of companies: from Mr. Tortilla, which makes low-carb chips; to FOLKUS, which sells paper made from stone; to Doggy Bathroom, an indoor litterbox for dogs.

Retailers who attended NRF were invited to vote for their favorite products at the showcase. Cosmetics company Chica Beauty won first place and $15,000; CordBrick, which makes accessories to help consumers organize devices and cords, took second place and $10,000.

Overheard on the show floor:

“Technology is not just for luxury.” — Gaia Vernagliano of 3D commerce platform Zakeke

“AI is fading into the background” to become part of everyday business. — Michelle Bacharach, CEO of retail content engine FindMine

“We want to put information as close to the customer as possible in the best way” to make it easy for them to shop with us. – Tony Drockton, CEO of luxury handbag retailer Hammitt

Optimism amid economic headwinds

Economists speaking at an event for press and analysts were split on whether the United States is heading into a recession this year. NRF Chief Economist Jack Kleinhenz and Morgan Stanley’s Sarah Wolfe predicted we’ll avoid recession, while KPMG’s Kenneth Kim said his firm foresees a recession coming in the first half of the year.

Despite lingering uncertainty about the economy, though, the economists all saw bright spots for retail. Even as inflation constrains some household budgets, many consumers still seem willing to spend, they said, and credit conditions are favorable. Holiday spending at the end of 2022 was higher than the previous year, setting retailers up for a relatively strong 2023 – especially if inflation eases.

“Don’t prepare for the downturn. Prepare now for the recovery,” said Ira Kalish, Chief Global Economist at Deloitte, highlighting labor shortages, supply chain challenges, geopolitics, and climate change as elements that will here to stay as part of the long recovery.