AI is at the forefront of most retailers’ strategies for the year ahead, as rapid advances unlock new opportunities but also bring some questions and challenges.

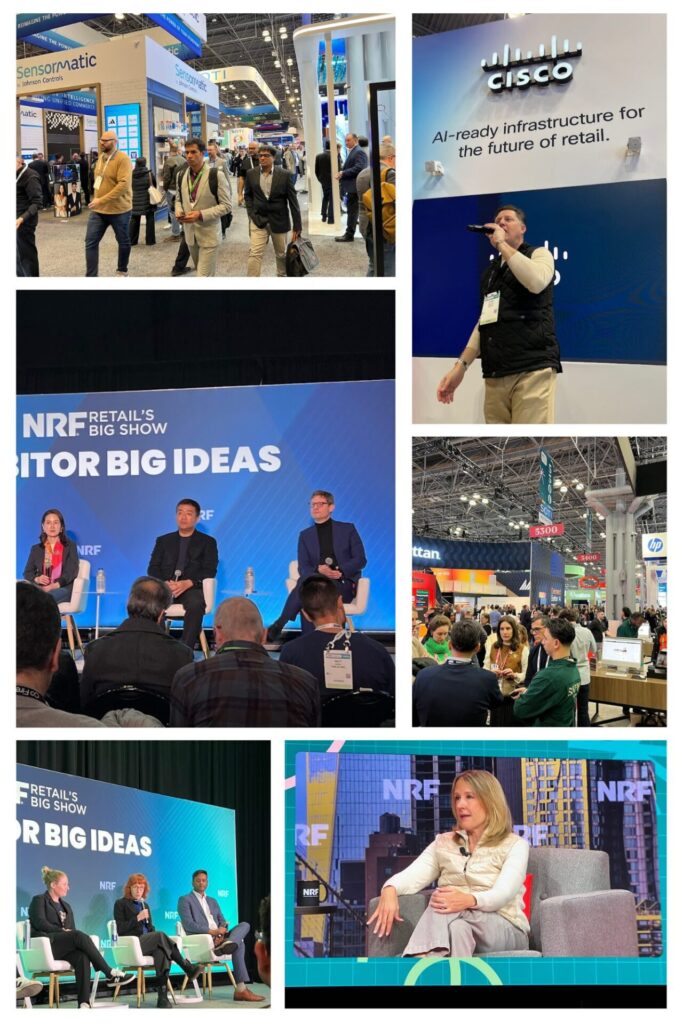

It’s no surprise, then, that AI dominated the conversation at the National Retail Federation’s Big Show in New York City, held January 11–13. The industry’s largest global event drew more than 40,000 attendees — many of them focused squarely on one question: how to make AI work for their business.

If last year was about harnessing the power of AI to automate back-office tasks, 2026 will be the year AI moves to the front and center of customer-facing interactions, predicted Richard Koo, partner at venture capital firm DNX Venture.

Agentic commerce poised to take center stage

There are always a few buzzwords or phrases that seem to dominate conversations at NRF and “agentic commerce” was one of them this year. Leaders of multiple brands spoke of the growing impact they expect agentic AI to have this year and how it will change the way they do business.

They have good reason to obsess about AI. This holiday season, generative AI tools drove a nearly 700% increase in traffic to retail sites compared to last year, according to research from Adobe Analytics. What’s more, AI and agents influenced 20% of all holiday retail sales, or $262 billion in revenues, according to Salesforce research.

“Our belief is that AI doesn’t have to make the world more mechanical,” said Soumia Hadjali, global senior vice president of client development, digital and omnichannel at luxury retailer Louis Vuitton. “It can make it more human” by using context and data to deepen connection and customer intimacy. She discussed an environment where agentic digital concierges work in parallel with client advisors, who can focus on high-value customers or ones who require a specific approach.

Agentic AI’s effect on retail is two-fold: shoppers are increasingly using agentic AI to shop on their behalf, which companies need to prepare for and strategize around, and companies are experimenting with how agentic AI can make operations more efficient on the back end.

Right now, agentic commerce is evolutionary – but as adoption scales, the retail industry seems to be heading toward a tipping point when it could become revolutionary, said Jose Gomes, vice president of retail and consumer at Google Cloud.

Home Depot is expanding its “Magic Apron” tool to incorporate more agentic AI. What began as a generative AI tool intended to answer customer questions and provide product reviews is expanding its capabilities to be more predictive, according to Jordan Broggi, the chain’s executive vice president of customer experience and online.

Newer agentic AI-powered features, he said, will look not just at the items customers are buying but at what projects they are undertaking. This more holistic view of what customers want to accomplish will let the retailer proactively suggest items that meet customers’ needs.

As long-standing retailers try to meet the changing preferences of modern shoppers, new companies are stepping in to help.

ReFiBuy, a company founded in 2025 and featured at NRF’s Innovators Showcase, helps retailers and brands prepare for this next wave. It’s an agentic-native platform that maps retailers’ online content so it’s discoverable by generative AI. As consumer habits evolve, companies need to be optimizing content for agentic commerce, said CEO and co-founder Scot Wingo.

Where AI is showing up in retail, right now

Beyond just agentic, conversations about AI dominated much of the expo floor displays and panel discussions at NRF.

The philosophy at Macys Inc. is to start with the customer and create stories worth sharing that build trust and relationships, said Max Magni, the retailer’s chief experience and digital officer. “We embrace AI. It helps us listen to customers, better personalize at scale, and give customers what they want.”

He added that if the technology doesn’t help support storytelling, they won’t use it. It must be right for the brand.

Mandeep Bhatia, senior vice president of global product and omnichannel innovation at Tapestry Inc., said the company – which owns brands including Coach and Kate Spade – recently began using an AI-powered platform that gives in-store employees and managers real-time visibility into what products are selling, how the store stacks up against its key KPIs, and how it compares to other stores within the company.

Happy employees lead to happy customers, he said, so the company’s AI investments are largely focused on making store associates’ jobs easier.

“Associates are at the heart of our business,” he said. He predicted that “anything that can be automated, ultimately, will be automated” so brands should look for ways to boost efficiency and remove friction with AI without sacrificing customer experience along the way.

Another luxury brand, Ralph Lauren, is using conversational AI to deliver more personalized experiences to shoppers. Chief Branding and Innovation Officer David Lauren spoke of the growing role AI plays for the brand, including its “Ask Ralph” tool that helps shoppers craft and buy the perfect outfit.

The brand’s mission has always been to help customers look and feel their best, he said.

“Technology has been the most incredible tool for us to take that idea and make it relevant for a new generation,” he added.

Matthew Shay, NRF President and CEO, agreed and asserted that even for luxury brands, “the phone is the new flagship store.”

The customer is still the heart of retail

Technological advances are exciting, but retail leaders kept reiterating that the customer journey – not the latest tech or gadget – remains their core focus.

“Technology for technology’s sake is a fool’s errand,” said Shelley Bransten, corporate vice president of worldwide industry solutions at Microsoft. “You need to start with a vision.”

That sentiment echoed across various retail industries.

“Our job is really to figure out how we put the customer at the center of everything we do,” said Yael Cosset, executive vice president and chief digital and technology officer at grocery chain Kroger. “If you can’t simply articulate why it’s beneficial for the customer, don’t do it.”

Even as AI’s role grows, there will always be parts of the retail experience that will remain innately human, Home Depot’s Broggi said. The smell of sawdust when shoppers enter a Home Depot store, or the building workshops stores host for kids, are key parts of the brand’s culture.

“If we can take out the hard part of retail but keep the fun part of retail, that’s where I hope [AI] ends up,” he said.

* Editor-in-Chief Elizabeth Glagowski contributed to this article.